LIMARC honors the achievement of Eagle Scout by the children and grandchildren of our members. The first honoree is Eddie..

Tuesday October 1st @ 7:30 PM Board Meeting at the Levittown Library, 1 Bluegrass Lane, Levittown, NY *** This is..

Wednesday Sept. 4 – Board Meeting Levittown Library Wednesday Sept. . 11 General Meeting Levittown Hall Food at around 6:45..

The 2024 edition of LIMARC Field Day 2024 was not without some major challenges. Nearby lightning strikes caused us o..

*The park closes over-night. Please use simplex frequency 146.58 or call 516-650-7581 for entrance information if the gate is closed…

The outdoor hamfest, on June 2nd, attracted close to 300 attendees! A nice number for us and we thank everyone..

Quality Test Bench Equipment at affordable prices. Discount for LIMARC members. See our Member Benefits page HERE. Visit the UNI-T..

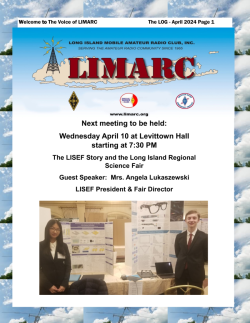

Refreshments at 7 PM. Business meeting at 7:30.

The School Club Round-up enjoyed the largest number of entries in mam year. After eking it out during Covid and..